XRP faces $650M sell risk as charts hint at prices below $1

XRP’s weakening technical setup suggests a drop below $1 could be in the cards over the next few weeks as supply rises on exchanges.

XRP’s weakening technical setup suggests a drop below $1 could be in the cards over the next few weeks as supply rises on exchanges.

At their worst levels, U.S. stock index futures had been down more than 2%, but equity markets are barely lower one hour into Monday’s trading session.

The ether treasury firm now has nearly $10 billion in assets and more than $6 billion of ETH staked.

Qivalis is a group of 12 major EU banks developing a euro-pegged stablecoin they plan to debut in the second half of the year.

After the 2023 crackdown, Nexo reenters the US with a partner-led model. What is different, and what should users watch?

Led by Executive Chairman Michael Saylor, the company raised the annual dividend on its widely-followed preferred STRC (“Stretch”) series by 25 basis points.

Bitcoin avoided a fresh breakdown around major geopolitical events in the Middle East, with BTC price targets now including $74,000 next.

The OCC’s proposal’s stablecoin yield procedures are the most ambiguous in that rulemaking plan.

Historically, bitcoin bear markets have lasted 12-13 months, suggesting a potential downturn until late 2026 if priced in USD.

The company holds about 8,285 bitcoin in Coinbase Prime custody, a stake now worth roughly $545 million after a $235 million decline in value over the past three months.

A full closure of the strait is unlikely or impractical, some experts argue.

Mark Karpelès submitted a pull request to Bitcoin Core that would redirect coins that have remained untouched since 2011 to a recovery address controlled by the MtGox trustee, reigniting the oldest debate in Bitcoin.

The strikes caused bitcoin’s price to fall and oil futures on Hyperliquid to rise over the regional conflict’s consequences.

Traders who bought Bitcoin three to five years ago are still up around 90% on average, even after the latest correction.

The EU’s new crypto tax rules will require platforms to report user data and transactions, reshaping tax transparency for digital assets starting in 2026.

The UK lender is reportedly seeking a technology partner to support blockchain-based payments and deposits as stablecoin adoption accelerates across finance and Big Tech.

Several analysts forecast Bitcoin extending its bear market into late 2026, with potential cycle lows between $30,000 and $45,000 backed by rising exchange reserves.

The Gambling Commission said there is increasing searches and consumer demand for crypto payments in the United Kingdom, which sometimes leads them to illegal websites.

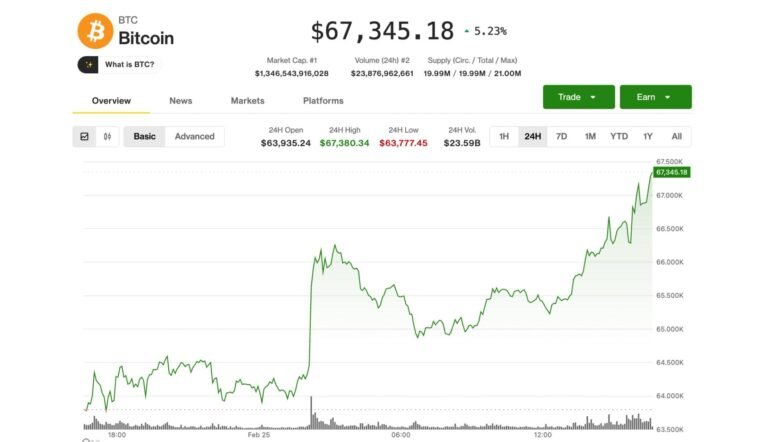

Bitcoin struggled to breach $70,000 this month, while inflation rates decreased in Japan and some countries reevaluated crypto tax codes.

Crypto is becoming a permanent 401(k) fixture. We detail the shift from regulatory bans to presidential mandate and new DOL guidance, plus the latest big institutional bets.

Ethereum’s looked bullish, with onchain data showing that the ETH price may have hit a macro bottom as a key support level holds.

The declines are coming as the Nasdaq tumbles nearly 2%, led by a post-earnings selloff in Nvidia.

Also: Ethereum’s “strawmap”, Robinhood chain update and OpenAI + smart contracts

In an interview with Cointelegraph, CEO Nic Puckrin breaks down the forces behind Bitcoin’s bear market and what could come next in 2026.

Ether, solana and dogecoin are among the altcoins posting 10% or more advances.

The stablecoin issuer reported $770 million in revenue for the final 2025 quarter, beating forecasts as full-year sales rose 64% and USDC circulation topped $75 billion.

Bitcoin began an assault below the 200-week exponential moving average in fresh signs of upward BTC price momentum at the start of the US session.

The company’s stock has lost about two-thirds of its value since peaking last year, nearly in step with bitcoin’s record price above $126,000.

Break above $1.37 draws strong spot demand, with ETF inflows and retail buying suggesting positioning shift.

BTC price targets stayed bearish with a zone of interest below $50,000 as macro assets saw increasing downside pressure at the Wall Street open.

The blockchain analytics company will incorporate locally and hire in the kingdom’s Special Administrative Region as the region advances its digital asset strategy.

The Tether-backed crypto payments app is expanding beyond retail spending with wallet-based off-ramps into domestic banking rails.

The crypto exchange is bringing U.S. stocks closer to the crypto world, letting users trade derivatives of tokenized stocks around-the-clock and with 20x leverage.

Back remains optimistic despite the brutal price action in bitcoin and BTC treasury companies.

The USD1 token briefly fell to $0.994, some 0.6% below its $1 peg, CoinGecko data shows.

The nationwide RateFi product allows borrowers to count crypto holdings toward mortgage underwriting requirements without selling their assets.

Bitcoin gained both upside and downside targets as the Wall Street open brought fresh BTC selling pressure and tariff reactions began.

The national trust charter institution would consolidate custody services under a single framework under federal oversight.

The company, which has raised more than $750 million from investors, repurchased about $350,000 worth of its stock.

President Donald Trump raised the global tariff rate to 15% despite a Supreme Court ruling against earlier emergency trade measures, keeping pressure on China and other partners.

Past capitulation waves have preceded sharp recoveries, but this time price is still fighting technical resistance even as ledger activity surges.

Analysts speculated that a large issuer like Circle might be moving reserve assets en masse into the ETF, but data show otherwise.

Bitcoin past performance gave 88% odds of higher prices by early 2027, the latest in a series of new bullish BTC price predictions.

A fully automated bot quietly captured micro-arbitrage opportunities on short-term crypto prediction markets, netting nearly $150,000

Private-equity firm Blue Owl Capital (OWL) tumbled nearly 15% this week as it was forced to liquidate $1.4 billion in assets to pay investors looking to exit one of its private credit funds.

IoTeX said it is assessing suspicious activity tied to a token safe, coordinating with exchanges to trace funds after analysts linked the incident to a possible private key compromise.

ECB president Christine Lagarde is a crypto skeptic, but her likely successors are no more enthusiastic about cryptocurrencies.

US spot Bitcoin ETFs logged five straight weeks of outflows, with $315.9 million leaving last week as institutional investors de-risk amid macro uncertainty.

As has been typical in crypto markets of late, even the most modest move higher was met with immediate selling.

Crypto, real estate and politics collided at Trump’s Mar-a-Lago club as insiders debated tokenization and regulation.