Companies spent $1.2B on Bitcoin last week, but BTC ETFs stole the show

Bitcoin-stacking companies bought over 6,700 BTC last week with the majority of the buying came from Japanese investment firm Metaplanet.

Bitcoin-stacking companies bought over 6,700 BTC last week with the majority of the buying came from Japanese investment firm Metaplanet.

Good Morning, Asia. Here’s what’s making news in the markets: Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed

Traditional banks will be battling with stablecoin issuers for retail depositors when the stablecoin-focused GENIUS Act takes full effect in a win for everyday people.

Bitcoin exchange balances plunged to six-year lows as over $14 billion left CEX platforms in a fortnight, as the asset powered to a new peak price.

Bitcoin (BTC) surged during the Asian session on Sunday, rallying from $122,000 to $124,289 within minutes, pausing short of the record high of $124,429 reached in August. The break above $124,000 followed a massive demand

Bitwise’s Matt Hougan said Solana’s speed and finality make it Wall Street’s top choice for stablecoins and tokenization despite Ethereum’s dominance.

Yield-bearing stablecoins will force traditional banks and legacy financial institutions to offer customers real yield on their deposits.

Coinbase said seeking the license is part of its broader effort to bridge the gap between crypto and traditional finance.

Ripple cryptographer J. Ayo Akinyele says he’s pushing to make the XRP Ledger (XRPL) the “first choice for institutions seeking innovation and trust” — and to do it with privacy-first tooling. Akinyele, a senior director

Bitcoin rallied close to $124,000 as surging US demand for BTC, shifting Federal Reserve monetary policy and hopes for a bullish Q4 lifted investor sentiment.

As stablecoins pass $300 billion market cap, Paxos Labs’ Bhau Kotecha says AI agents could turn market fragmentation into an advantage by routing liquidity to top issuers.

Bitcoin demand has been quietly expanding since July, setting the stage for what could be another late-year rally to over $200,000 Apparent demand has grown at a rate of roughly 62,000 BTC per month, according

A new thesis from DeFi analyst Patrick Scott argues that despite losing market share to rivals, Hyperliquid remains the most investable decentralized exchange for perpetual futures. Perp DEX market in flux Perpetual futures — or

When the AI delegates rollout, it will be done in stages, with early models similar to chatbots, then representing large groups, and finally, each DAO member.

There is a Unity engine vulnerability that allows third parties to inject code into mobile games, potentially compromising crypto wallets, sources have told Cointelegraph.

New snake oil? Etsy witches are hawking spells they claim can change the weather on your wedding day, help you with your love life, or fatten your crypto portfolio.

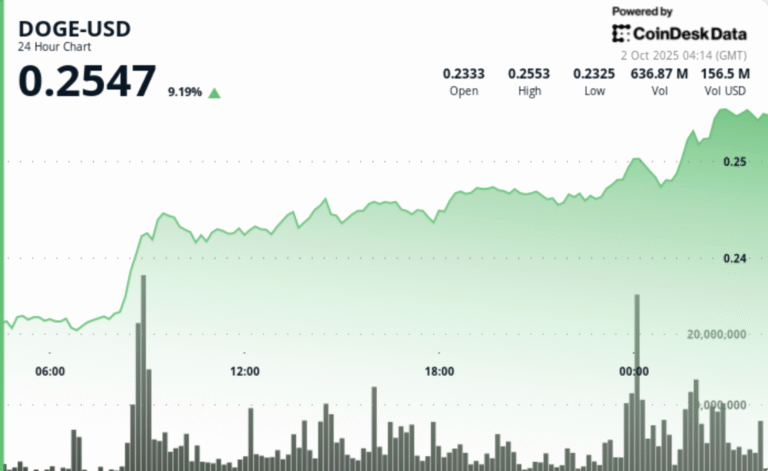

Dogecoin ripped nearly 9% higher, breaking through resistance on more than a billion tokens traded. Support reset to $0.242 after an early breakout, while late-session flows pushed DOGE into the $0.254 zone before consolidation. Traders

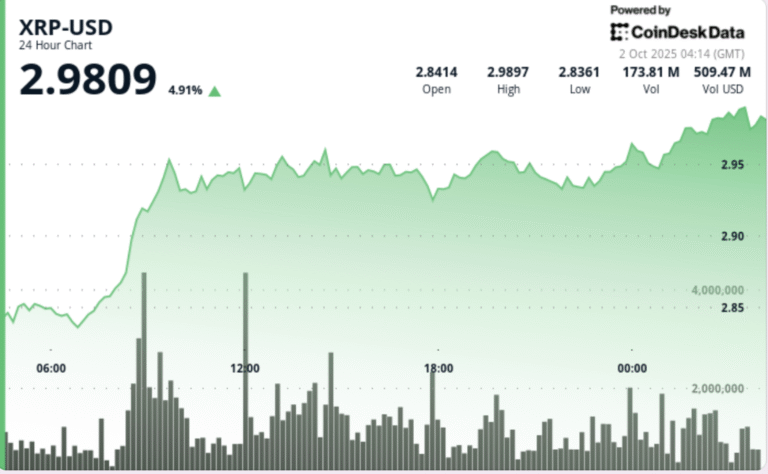

XRP surged to fresh highs after Japan’s SBI unveiled an institutional lending initiative, igniting volumes above 160M and lifting price through key resistance. Buyers defended $2.93 multiple times as flows consolidated, with the October 18

Bitcoin surged 4% to $119,450, its highest in seven weeks as expectations of Fed rate cuts and October’s bullish history drove crypto market gains.

A broad altcoin rally is unlikely, as crypto projects haven’t generated enough excitement to stir traders into action, Bitget operating chief Vugar Usi Zade tells Cointelegraph.

The proposal has come from two Swedish Democrats, a party that is a key player in backing the Swedish ruling coalition and its minority government.

A group of House Republicans said they’re engaging with the SEC’s Office of Inspector General to find out more about former SEC Chair Gary Gensler’s deleted text messages.

White hat hacker collective SEAL has acknowledged 29 companies for supporting its Safe Harbor framework, enabling ethical hackers to defend user funds during live attacks.

Telegram CEO Pavel Durov revealed he bought thousands of Bitcoin in 2013 at $700, and the investment has allowed him “to stay afloat.”

The SEC’s Division of Investment Management said it wouldn’t recommend that the agency take action against advisers who use a state trust company as a crypto custodian.

MEXC Ventures has doubled down on its investment in the Ethena ecosystem, bringing its total exposure to $66 million, according to a press release shared with CoinDesk. The latest move includes a $14 million investment

A Bloomberg ETF analyst said the Tuttle Capital Government Grift ETF could launch this week, allowing retail investors to make similar trades to US Congress members.

Project Mirror surveyed members of the Ethereum community, finding that Ethereum’s technical strength is invisible without narrative clarity.

OKX SG, the Singapore-based unit of OKX, said it is bringing the crypto exchange’s integrated payments service, OXK Pay, to the city-state through a stablecoin-powered scan-to-pay service tie-up with Southeast Asia’s “everyday everything” app, Grab.

Washington has a narrow window to deliver clear U.S. crypto rules, Ripple Chief Legal Officer Stuart Alderoty argues, urging lawmakers to “finish the job on crypto clarity.” In an op-ed published Monday on RealClearMarkets, Alderoty

Keel, a new Solana-native capital allocator, debuted on Tuesday with a roadmap to channel up to $2.5 billion across decentralized finance (DeFi) and tokenized asset markets in the Solana (SOL) ecosystem. Keel is structured as

New York City Mayor Eric Adams is officially out of the mayoral race, plunging the city’s pro-crypto push into limbo.

Protests erupted in Madagascar’s capital, Antananarivo, last Thursday over ongoing water and power cuts, with demonstrations later spreading across the country.

NYDIG’s Greg Cipolaro argues that a popular metric for valuing crypto companies should be retired as it misleads investors.

Early Hyperliquid users have been rewarded with a massive Hypurr NFT airdrop, with the free digital cats now worth over $64,000.

Jump Crypto has proposed removing Solana’s fixed compute block limit to prioritize high-performance validators to handle complex blocks over suboptimal validators.

A CoinGecko survey published on Monday found that 10% of respondents have never bought Bitcoin, and only 54% of newcomers started with it in their stash.

Creating a national Bitcoin reserve could prove disastrous for markets, as it would signal an immediate shift in the global financial order.

Crypto treasury firms that stockpile tokens could evolve from speculative wrappers into long-run economic engines for blockchains, argues Syncracy Capital co-founder Ryan Watkins. Digital asset treasury (DAT) firms are publicly traded companies that raise capital

Traditional financial instruments cushion volatility and attract institutional investors to Bitcoin — a sign of market maturation.

Mike Novogratz said “of course” Bitcoin could reach $200,000 if the Federal Reserve adopts a highly dovish stance following a leadership change.

Bitcoin struggles to recover and rally despite favorable macroeconomic trends that have sent stock prices higher. What will it take to overcome $110,000?

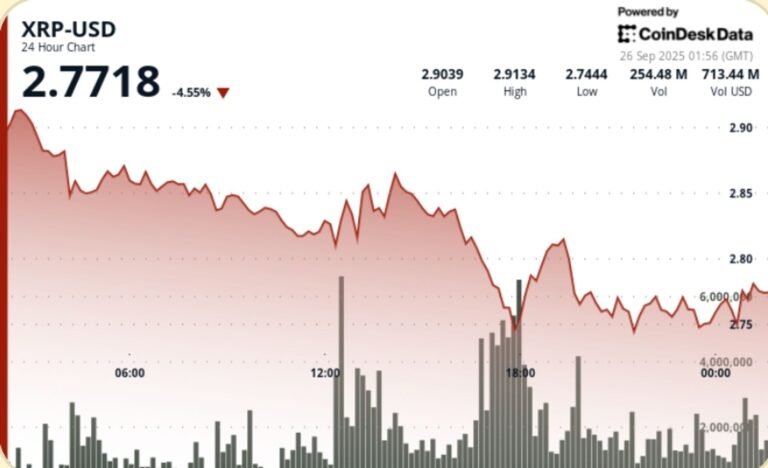

XRP consolidated near $2.75 with bearish pressure looming. Onchain data and liquidity compression suggest a possible dip before a price rebound.

Moody’s warns “cryptoization” is undermining monetary policy and bank deposits in emerging markets amid uneven regulatory oversight.

MGX, a fund backed by Dubai’s ruling family, will take a 15% stake in TikTok’s U.S. business as part of a restructuring meant to increase American control of the popular video app, the Washington Post

Bitcoin dropped to under $109,000 as long-term holders realized 3.4 million Bitcoin profits and ETF inflows slowed, signalling potential cycle exhaustion.

Favorable policy shifts, growing ETP access, and stablecoin momentum could be the key themes for the crypto market coming into Q4, analysts told Cointelegraph.

Bitwise is looking to launch an exchange-traded product tracking Hyperliquid’s token, amid volumes on crypto futures exchanges hitting all-time peak volumes.

An ether (ETH) trade on Hyperliquid turned out to be the biggest liquidation hit in the past 24 hours as crypto traders took on more than $1.19 billion in leveraged positions amid a market downturn.

XRP’s push above $2.90 collapsed under heavy selling on Sept. 25, with a $277 million volume spike hammering price back to $2.75. The move erased more than $18 billion in market value over the past