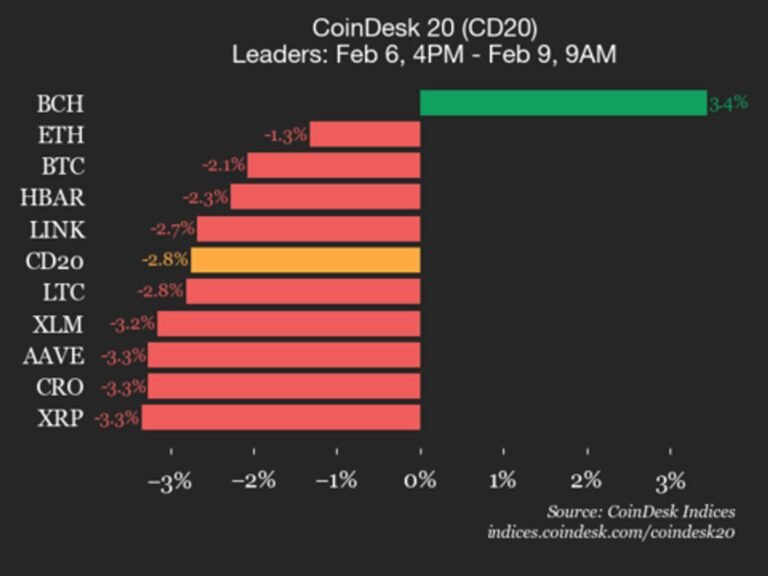

CoinDesk 20 performance update: AAVE falls 3.3%, leading index lower

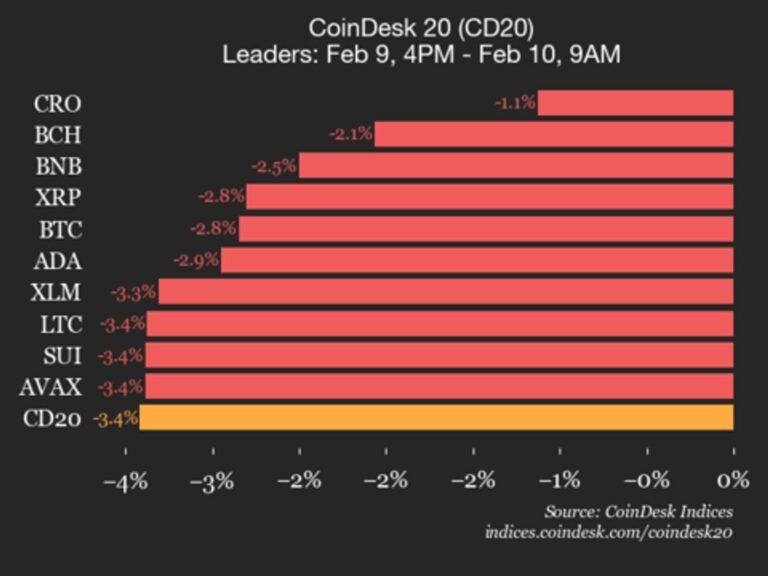

Bitcoin Cash (BCH), down 2.1% from Thursday, was also among the underperformers.

Bitcoin Cash (BCH), down 2.1% from Thursday, was also among the underperformers.

US Federal Judge Aleta Trauger granted Kalshi a preliminary injunction against Tennessee, finding its sports event contracts fall under CFTC jurisdiction.

Market analysts said the extreme downside scenario risked influencing real capital flows, prompting a heated public debate over bitcoin’s macro outlook.

Initial features will support basic transfers, setting the stage for subsequent upgrades, including privacy features for tokenized real-world assets.

Royal family-linked mining rigs are producing about 4 BTC a day, turning state-backed infrastructure into a steady sovereign bitcoin machine

The Singapore-based bitcoin miner and AI data center firm is raising capital to repurchase notes and fund expansion.

The rise of artificial intelligence is likely to displace millions of workers in quick order, triggering sizable credit defaults, said Hayes.

Jake Chervinsky, CEO of the Hyperliquid Policy Center, said markets are migrating to blockchain, and the U.S. need to adopt new rules of risk being left behind.

Ultan Miller touts a blockchain-based pre-IPO index, while critics warn unauthorized equity tokenization risks legal and investor fallout.

The Nasdaq-listed SUIS fund offers direct exposure to Sui’s native token while passing through proof-of-stake rewards in a regulated ETF wrapper.

Solana (SOL), down 2.5% from Tuesday, was also among the underperformers.

StarkWare is integrating EY’s Nightfall privacy protocol into Starknet to give institutions private payments and DeFi access on public Ethereum-aligned rails, while preserving auditability.

Crypto exchange says Marshall Beard, Dan Chen and Tyler Meade are departing effective immediately; Cameron Winklevoss to take on COO duties as board names interim finance and legal chiefs.

Ripple (XRP), down 1.5% from Monday, was also an underperformer.

At Consensus Hong Kong 2026, Leo Fan questioned Midnight’s use of Google Cloud and Azure, as Charles Hoskinson justifies hyperscaler partnerships.

From bank-led stablecoins to tokenized T-bills and AI-powered wallets, digital assets will move from pilot projects to financial plumbing this year.

Nexo exited the US in 2022, citing regulatory hostility toward the crypto industry from federal and state financial regulators.

The shift may be due to complex market dynamics, potentially reflecting the unwinding of a trade that capitalized on bitcoin treasury companies trading at premiums to their mNAV.

The digital assets wealth platform’s rollout includes regulated yield accounts, credit lines and exchange access backed by Bakkt.

Ray Dalio warns that the rules‑based order is now over, putting monetary debasement, dollar risk and neutral, permissionless financial rails back at the center of the macro conversation.

Rampant speculation on crypto derivatives platforms is fueling volatility and risking bitcoin’s image as a stable hedge, says BlackRock’s digital assets chief.

XRP is outperforming bitcoin and ether following signs of dip buying during recent crash.

Trump-linked WLFI dropped more than five hours before a $6.9 billion crypto liquidation event, raising questions about early market stress signals.

The difference in futures basis between CME and Deribit reflects varying risk appetite across regions.

ShinyHunters hackers leaked user data after a social-engineering attack on a Figure employee and the company reportedly refused to pay a ransom.

Despite the price recovery, the Crypto Fear & Greed Index remains in “extreme fear,” indicating underlying market anxiety.

Cathie Wood’s ARK Invest added nearly $15.2 million in Coinbase stock across three ETFs, reversing course days after offloading more than $39 million in shares.

US spot Bitcoin ETFs recorded four straight weeks of net outflows, with about $360 million withdrawn in the latest week.

Bitcoin bulls enjoyed a relief rally to $69,000 on the back of soft US CPI inflation data amid hopes of BTC price action making a “higher low.”

DeFi Education Fund says developers of non-custodial protocols should not be regulated as intermediaries under the U.K.’s proposed crypto regime.

Stańczak came aboard in 2025 after the exit of longtime chief Aya Miyaguchi amid criticism the foundation wasn’t doing enough to push the Ethereum ecosystem.

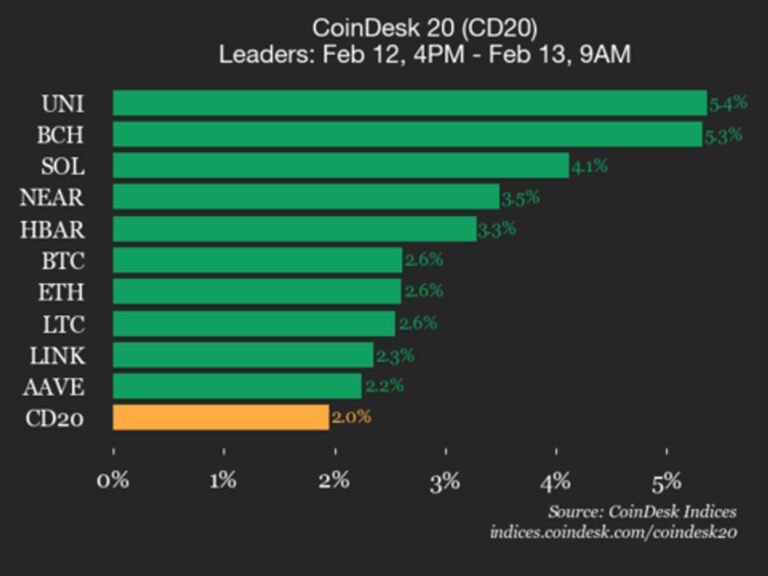

Bitcoin Cash (BCH), up 5.3% from Thursday, joined Uniswap (UNI) as a top performer.

The bank cuts its 2026 crypto price targets, warning of further near-term capitulation as ETF outflows and macro headwinds weigh on digital assets.

Experts at Consensus Hong Kong said regional focus on user utility and stablecoin regulation is driving adoption.

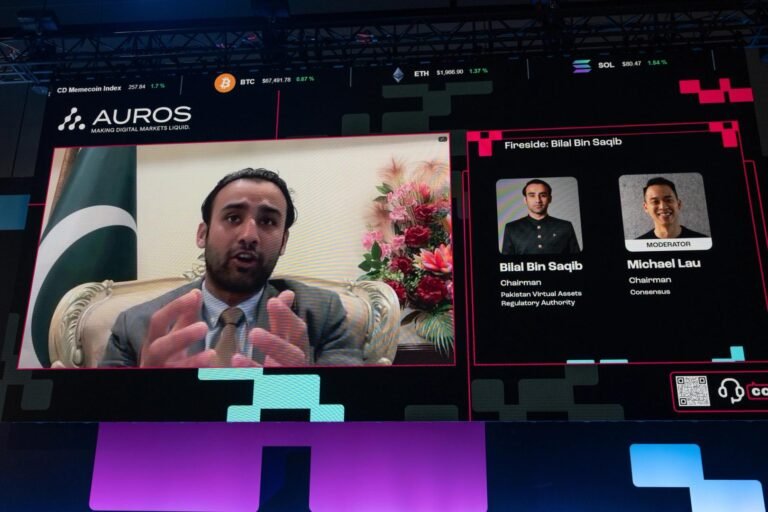

Regulation of digital assets is a great opportunity for emerging markets, said Pakistan’s crypto regulation lead.

Panelists at the conference discussed how regulatory progress in Hong Kong and Japan creates a structured path for capital allocation.

The head of the fourth-largest crypto exchange by daily trading volume also said he believes bitcoin’s four-year cycle is no longer a thing.

Bitget CEO Gracy Chen says AI trading apps are like interns for now; soon they will be full time employees.

Moving away from overhyped GPU marketplaces and large AI model alternatives towards purpose-built, full-stack solutions is the goal.

BlackRock will make shares of its $2.2 billion tokenized U.S. Treasury fund tradable on the decentralized exchange Uniswap.

JPMorgan and Compass Point were among the sell-side teams trimming price targets on HOOD.

Flash Freezing Flash Boys is a novel proposal for per-transaction encryption to prevent frontrunning.

Aptos (APT) declined 5.5% and Ethereum (ETH) dropped 5.4%, leading the index lower from Monday.

Analysts are split on whether the drop represents a cycle low or a pause before further downside.

Bitcoin sparked mass long and short BTC liquidations while staying rangebound around $70,000 as analysis predicted a local support retest.

SOL’s price has validated a classic head-and-shoulders pattern on multiple time frames, with a price target of around $50.

The firm’s total ETH holdings top 4.3 million tokens worth about $8.7 billion at the current price just above $2,000.

The sale shows how Bitcoin miners are reshaping strategies as mining economics continue to deteriorate.

Aptos (APT) declined 9.4% and NEAR Protocol (NEAR) fell 8%, leading index lower.

Bitcoin price analysis stayed bearish on the outlook for BTC, predicting new macro lows in a repeat of the 2022 bear market.