Block weighs cutting up to 10% of jobs: Bloomberg

The company has told hundreds of employees their jobs are at risk as part of a broader overhaul.

The company has told hundreds of employees their jobs are at risk as part of a broader overhaul.

Analysts forecast Block to post $403 million in Q4 profit on $6.25 billion revenue, following a third quarter marked by strong gross profit growth but mixed market reaction.

Cathie Wood’s ARK Invest sold 134,472 Coinbase shares across three ETFs while buying over 393,000 shares of crypto platform Bullish.

Hong Kong hedge funds’ leveraged BTC price bets are emerging as the main trigger behind Bitcoin’s sharp month-long sell-off.

EY Digital Assets leaders Mark Nichols and Rebecca Carvatt argue that the wallet is no longer just a crypto tool, but the primary strategic interface for the next generation of global finance.

Tether claims it has helped law enforcement in over 1,800 cases across 62 countries, freezing $3.4 billion in USDT tied to suspected illicit activity.

Bitcoin market participants diverged on the short-term BTC price outlook, with warnings of new macro lows contrasting with $84,000 targets.

The weaker results were tempered by continued progress in the bitcoin miner’s shift toward AI infrastructure.

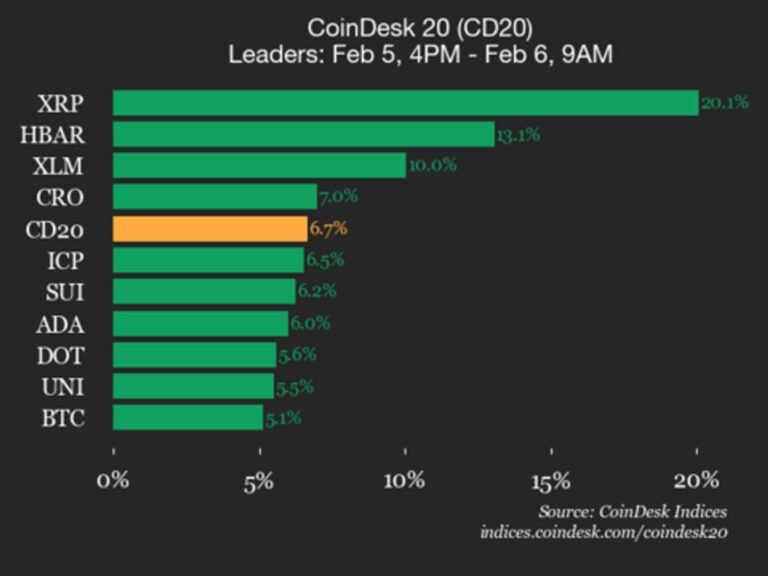

Hedera (HBAR) was also among the top performers, rising 13.1% from Thursday.

Crypto super PACs are getting millions of dollars in contributions to spend supporting candidates who will advance their policies in Washington.

The bank trimmed its Coinbase revenue and earnings forecasts amid a brutal risk-off environment for crypto and delays around U.S. market structure legislation.

Bitcoin Core maintainer Gloria Zhao has stepped down and revoked her PGP signing key after six years as one of the project’s most influential mempool and policy engineers.

The German lender pointed to institutional outflows, fading liquidity and stalled regulation as the real drivers behind bitcoin’s slump.

Bitcoin risks a deeper slide as miners and US spot ETFs cut BTC exposure, adding supply pressure during a fragile downtrend.

Custodian Hex Trust will let clients mint and redeem FXRP and stake FLR through its platform, giving institutions a way to put XRP to work.

The new facility allows institutions to redeem tokenized real-world assets into stablecoins instantly, addressing a key liquidity bottleneck in onchain markets.

The EU must fix its pilot regime now or watch capital markets shift permanently to the U.S., a group of blockchain firms warned policymakers on Thursday.

Canaccord’s Joseph Vafi slashed his price target on the plunging bitcoin treasury company’s stock by more than 60%.

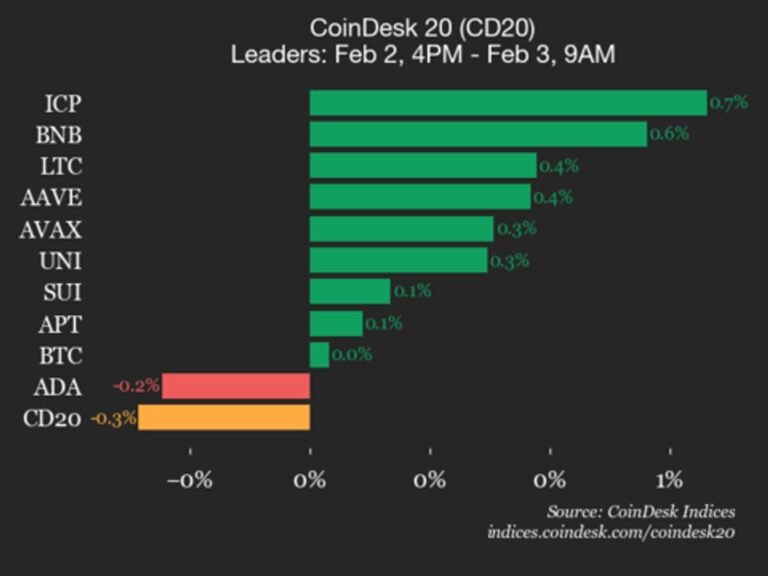

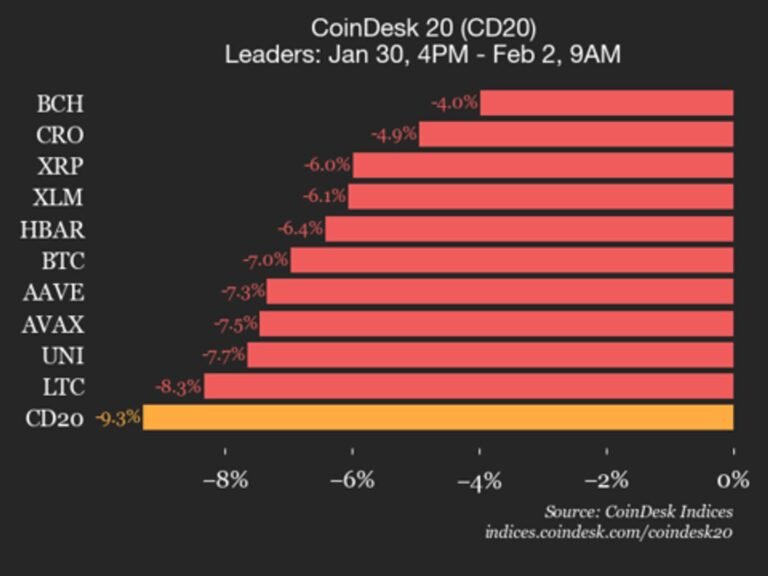

Uniswap (UNI) was also among the underperformers, declining 3.6% from Tuesday.

Bitcoin is approaching its 200-week moving averages, a long-term support zone traders say could help define a potential BTC price floor.

Senior decision-makers flagged liquidity constraints and market depth as key barriers to institutional crypto adoption in 2026.

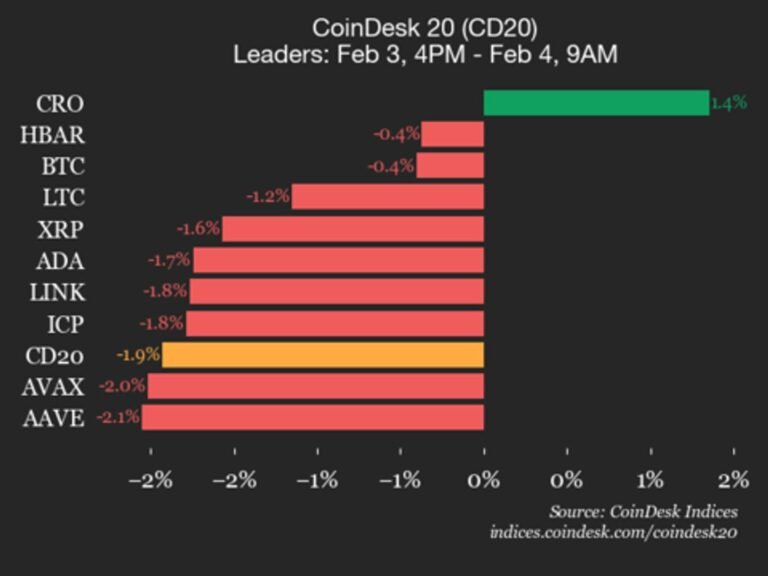

Hedera (HBAR) declined 2% and Stellar (XLM) dropped 1.6%, leading the index lower from Monday.

The acquisitions bring TeraWulf’s capacity to 2.8 gigawatts as it targets major infrastructure expansion to supply power-hungry computing demand.

The Spanish Red Cross is rolling out RedChain, a privacy-preserving blockchain aid system that gives donors cryptographic proof of impact without exposing beneficiary identities.

A new report finds most crypto press releases come from high-risk projects, raising questions about disclosure, hype and market manipulation.

By several measures, activity on the network remains near peak levels, which has industry leaders plussed about the plunge in ether’s price.

Ethereum (ETH), down 13.9%, lead the index lower over the weekend.

Warsh’s nomination as the new Fed chair has ignited US liquidity drought concerns, but his interest rate policy may hold the silver lining for risk asset recovery, according to market analysts.

Latest filings show Strategy bought 855 Bitcoin at about $88,000 each last week, as BTC briefly fell below its average cost for the first time since 2023.

The Financial Supervisory Service said automated models now scan crypto trading activity across timeframes, reducing reliance on manual investigations.

It was a relatively small purchase for the company, which now holds 713,502 bitcoin purchased at an average price of $76,052 each versus the current price of about $77,000.

Holders with large troves of unreported crypto held offshore are rightly getting nervous about new and invasive tax-reporting regimes.

The dividend increase follows renewed pressure on STRC, which has been trading below its $100 par value.

An Abu Dhabi investment vehicle backed by Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security adviser, agreed to buy 49% of World Liberty Financial for $500M.

Solana-based DeFi platform Step Finance disclosed a treasury wallet breach that saw over $27 million in SOL moved onchain, sending its STEP token down more than 90%.

The exchanges were accused of facilitating transactions for the Islamic Revolutionary Guard Corps and are linked to an Iranian businessman convicted of embezzlement.

NYSE and Nasdaq introducing 24/7 trading with tokenized stock would be a “godsend,” solving thin weekend liquidity, Ondo Finance President Ian de Bode told CoinDesk in an interview.

Months after Oct. 10’s flash crash and liquidation cascade, a fresh spat has opened between exchange executives and market watchers over whether a leveraged yield loop, thin liquidity, or busted market plumbing did the real

Activity on Solana has spiked as new AI tech makes it easier than ever to launch memecoins. Meanwhile, Ethereum is plugging away at future-proofing and bringing down fees.

stVaults let other teams plug into Lido’s staking system instead of building their own from scratch.

US President Donald Trump nominated former Fed Governor Kevin Warsh to replace Jerome Powell as Federal Reserve chair, setting up a Senate confirmation fight.

Ethereum slipped under $2,800 as charts and onchain data suggested downside risk remains elevated, with a potential move toward $2,100.

New product lets companies manage cash, stablecoins and tokenized funds in one system, cutting cross-border settlement times from days to seconds.

The parliamentary inquiry comes as regulators warn stablecoins could drain bank deposits and reshape payments.

Russian lawmakers plan crypto regulations by midyear, permitting trading for qualified and retail investors while banning anonymous coins and domestic payments.

Bitcoin order-book analysis said that BTC price action was being held back by just one trading entity, while risking a trip to “Bearadise.”

The $45 million Series B extension also includes participation from new strategic investors Sony Innovation Fund, IMC, QCP and Karatage.

Hashrate fell sharply as Bitcoin miners curtailed operations during extreme cold, boosting profitability for companies that stayed online.

While the increasingly professional bad guys’ crypto rocketed to $158 billion in 2025, it’s still a decreasing share of overall digital assets activity.

Bitget EU expects MiCA approval in Austria by mid-2026 and plans a broker-led model with strict asset standards for European users.