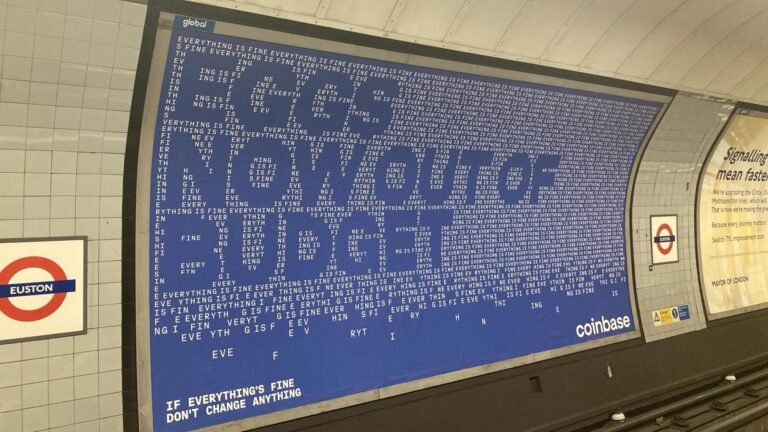

UK advertising watchdog bans Coinbase ads as ‘irresponsible’

The ASA banned Coinbase adverts concluding they imply crypto could ease the country’s cost-of-living crisis.

The ASA banned Coinbase adverts concluding they imply crypto could ease the country’s cost-of-living crisis.

DeFi is still out of scope for DAC8 and CARF, but AML enforcement trends suggest that may not last, according to Taxbit’s Colby Mangels.

Tether’s new US-regulated stablecoin, issued by Anchorage Digital Bank and backed by Cantor Fitzgerald reserves, launches on major exchanges under the US GENIUS Act.

The new token is issued by Anchorage Digital Bank and designed to comply with the GENIUS Act, targeting institutional demand for a U.S.-regulated digital dollar.

Post Content

The partnership targets Bitcoin treasury management for Japanese companies using Rootstock-based tools, including rBTC and RIF.

Already an investor in CoreWeave, Nvidia last September had agreed to purchase $6.3 billion of computing services from the AI infrastructure provider.

A researcher uncovered a 149 million-record credential dump from infostealer malware, including 420,000 Binance logins, exposing growing risks to crypto users.

Strategy acquired $264 million of Bitcoin last week during the market pullback, lifting its holdings to more than 712,000 BTC, according to a Monday SEC filing.

Bitcoin dipped below $87,000 as the Coinbase Premium hit 12-month lows, signalling weak US demand and with technicals hinting at a $66,000 BTC price target.

The company’s stack now stands at 712,647 BTC, worth about $62 billion at the current price of $87,500.

For those who don’t have the compass and the time to track Congress through its arcane procedures, here’s what’s likely to affect you if a bill passes. Or doesn’t.

The fourth-quarter crypto pullback hit ARK ETFs, with Coinbase emerging as the biggest drag on performance.

AFP Protección says access to the Bitcoin-linked fund will be limited to qualified investors and will not alter the core allocation of Colombian pension savings.

The Gemini-owned NFT platform will close on Feb. 23, 2026, entering withdrawal-only mode as another major casualty of the sector’s prolonged downturn.

Access and market structure issues limit adoption of Strategy’s first non U.S. perpetual preferred, Stream.

Some European policymakers have floated the idea of selling off US debt as a way of combating US belligerence, but it may be much more difficult in practice.

Proposed restrictions under the US CLARITY Act could drive demand for offshore and synthetic dollar products as investors seek yield outside regulated markets, experts warn.

As DeFi investors seek stable, uncorrelated returns, R3 is building Solana-native structures to bring private credit and trade finance into crypto markets.

Revolut is reportedly planning to apply for a US banking license through the OCC after previously considering a bank acquisition that could have required branch commitments.

Ledger is working with Goldman Sachs, Jefferies and Barclays to list in New York, potentially tripling its last valuation, the Financial Times reported.

Your day-ahead look for Jan. 23, 2026

Restaking yields come from token emissions and VC incentives, not productive activity. Complex models concentrate power among large operators, while compounding risk cascades.

The exchange confirmed it has applied for regulatory approval under the MiCA regime, part of a broader effort to regain footing in major markets.

Pantera Capital predicts a year of significant consolidation for corporate crypto treasuries, with a few large players dominating digital asset demand while smaller ones get bought up.

Elliptic said the ruble-backed A7A5 token functioned as a bridge into USDT markets before sanctions and exchange controls curbed its growth.

Bitcoin long-term holders of two years or more broke records during 2024 and 2025, says a new analysis of the latest bull market.

The bitcoin-owning company’s capital structure is shifting toward permanent capital, reducing refinancing risk and damping credit volatility.

Bitcoin’s 20-year quantum timeline collapses. 25% of the Bitcoin supply sits in vulnerable addresses requiring urgent migration.

Chainlink is a dominant software platform quietly powering stablecoins, tokenization, DeFi and institutional adoption across crypto, said Matt Hougan.

More crypto platforms are edging toward universal exchange ambitions, with research firms predicting a crypto “super app” race.

Trade finance’s financing gap and paper-based inefficiencies create blockchain’s largest opportunity. Tokenized receivables can unlock global liquidity for SMEs.

Your day-ahead look for Jan. 21, 2026

Attackers have hijacked trusted Snap Store publishers via expired domains, allowing malicious wallet updates to reach long-time Linux users.

Patrick Gruhn and Robin Matzke were the co-founders of Digital Assets, which was acquired by FTX’s Sam Bankman Fried in 2021 and rebranded as FTX EU.

Passive crypto hoarding exposes DATs to compliance risks while missing opportunities to provide patient capital. DAT 2.0 invests in infrastructure supporting ecosystem longevity.

The top nine wallets controlled nearly 60% of voting power in WLFI’s USD1 governance vote, raising questions about insider influence as locked holders were unable to participate.

Your day-ahead look for Jan. 20, 2026

South Korea is reportedly reviewing exclusive bank partnerships for crypto exchanges as regulators assess competition and prepare the Digital Asset Basic Act.

South Korea’s customs agency charged three suspects over a more than $100 million crypto-linked remittance scheme using WeChat Pay and Alipay, per Yonhap.

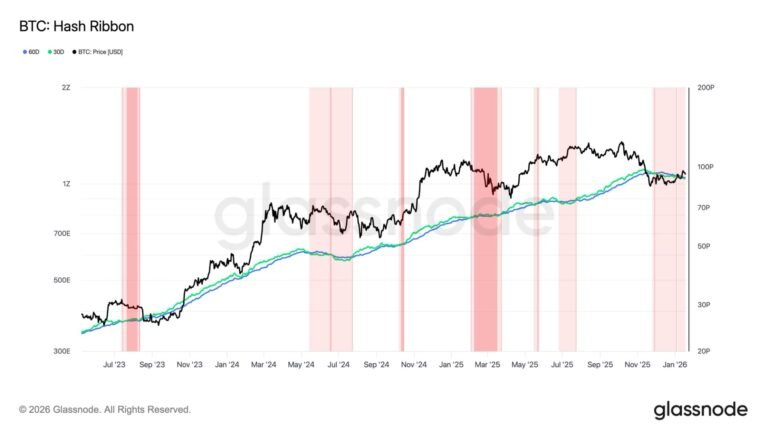

Bitcoin mining difficulty set for a 4% decline, the seventh negative adjustment in the past eight.

Starknet-based DEX Paradex reversed its blockchain to an earlier block after a database migration error briefly crashed bitcoin’s price to zero.

South Korean customs officials said they arrested three China nationals and have referred them for prosecution. They allegedly used an unauthorized crypto exchange to launder assets.

Cross-chain bridges concentrate risk and centralize trust, creating vulnerabilities that could trigger a systemic crypto crisis under stressed market conditions.

From macro tailwinds to trillion-dollar rails, the 50T Funds founder sees real-world adoption reshaping the crypto landscape.

Vitalik Buterin warns that Ethereum’s push to add new features while preserving backward compatibility is inflating protocol complexity, calling for a “garbage collection” process.

Crypto’s interoperability layer reveals a gap between the industry’s decentralization narrative and how value actually moves across blockchains.

Security failures don’t just drain funds, they often destroy trust, leaving most hacked crypto projects unable to recover despite fixing the technical flaws.

Spot Bitcoin ETFs posted their strongest week since October as institutional investors returned via regulated products, helped by reduced whale selling and tightening effective supply.

Two independent miners mined full blocks and collected roughly 3.15 BTC each, an uncommon outcome in a network dominated by large pools.