User loses $282M in one of the largest social engineering crypto heists

The crypto user was reportedly deceived by an attacker impersonating Trezor support, tricked into revealing their hardware wallet seed phrase.

The crypto user was reportedly deceived by an attacker impersonating Trezor support, tricked into revealing their hardware wallet seed phrase.

Coinbase withdrew support for the CLARITY Act, warning the draft would restrict DeFi, ban tokenized equities and eliminate stablecoin rewards.

Internal OpenAI call notes show Elon Musk agreed to explore an ICO with a for-profit arm in early 2018, but later dropped the idea and exited the organization.

Your day-ahead look for Jan. 16, 2026

Shares climb more than 5% in pre-market trading as the company reinforces long term Bitcoin strategy.

The rules allow banks to combine token activity with payments and financial services under central bank and tech park oversight.

The crypto lender’s agreement with the Formula 1 team follows its sponsorship of the Australian Open

Major CoinDesk indexes moved less than 1% on Friday as bitcoin consolidated above a key breakout level, while dash extended its advance.

Your day-ahead look for Jan. 15, 2026

Strategy’s preferred stock, STRC, sees a familiar ex dividend dip below the $100 par level.

The bank’s digital asset division SG-FORGE used its MiCA-compliant EUR CoinVertible stablecoin.

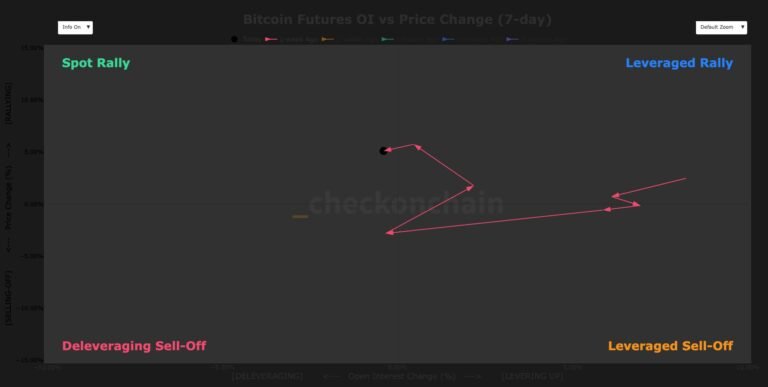

Onchain and derivatives data point to a healthier bitcoin price advance in early 2026.

Industry leaders say transaction-level taxes and loss restrictions are draining liquidity as India tightens crypto compliance and enforcement.

Your day-ahead look for Jan. 14, 2026

Bankinter joins Tether and BBVA in the $35 million investment round after the Spanish crypto exchange received its MiCA license in 2025.

Crypto markets pushed higher on Wednesday after bitcoin broke above a key resistance level, triggering heavy liquidations and paving the way for sharp gains across altcoins.

Perp DEXs handle only a fraction of the trading activity seen in TradFi investments, but their infrastructure is catching up to the slow and fragmented centralized trading venues.

Metaplanet shares approached the 637 yen trigger that reactivates the company’s moving strike warrants and unlocks hundreds of millions for new bitcoin purchases.

BNB Chain’s Fermi hard fork goes live on Wednesday, cutting BSC block times from 0.75 seconds to 0.45 seconds and tightening fast-finality rules.

The 21Shares Bitcoin Gold ETP allocates two-thirds to gold and one-third to Bitcoin and trades in pounds sterling and dollars on the London Stock Exchange.

Bitcoin pushed above $92,000 with rising volume; altcoins outperformed as traders rotated into privacy coins and memecoins.

Truebit lost $26 million after a smart-contract overflow bug let an attacker mint tokens at near-zero cost, sending the TRU price down 99%.

The move adds Ukraine to a growing list of countries, including France, Germany, the UK, Italy, Poland, Thailand and Australia, where Polymarket is already restricted.

DFSA’s new company-led suitability model and AML expectations would make it difficult for licensed firms to justify supporting privacy-focused assets.

Bitcoin briefly topped $92,000 on interest-rate uncertainty, while privacy coins hit fresh highs and memecoin activity lifted select altcoins.

Bitcoin led with $405 million of outflows last week, with the US shedding $569 million, as several altcoins and European funds posted modest inflows.

They argue that cryptocurrency’s opacity and traceability issues make it a threat to democratic integrity, citing an intelligence report election interference.

Star Xu defended freezing $40,000 in stablecoins after a user admitted buying verified accounts, with the exchange citing strict KYC and AML obligations.

X’s head of product said Crypto Twitter’s reach problems are self-inflicted, blaming overposting rather than algorithmic suppression.

Tennessee regulator warned that failure to comply could trigger steep fines, court injunctions and potential law enforcement referrals for for further investigation.

Jan3 founder Samson Mow’s predictions are among the more bullish outlooks compared with most recent forecasts from other crypto market participants.

Ethereum’s social media sentiment is “kind of reminiscent” of what was seen before its last major run, according to Santiment.

Spot Bitcoin ETFs reversed early inflows in 2026 and posted four straight days of outflows as fading rate-cut hopes and rising geopolitical risks pushed investors into risk-off positioning.

Pump.fun is introducing a new creator fee sharing system that lets teams and CTO admins split fees across up to 10 wallets, transfer coin ownership and revoke update authority.

A series of ads reportedly aired on Fox News, calling on the public to contact their senators to remove DeFi provisions from the CLARITY Act bill.

The asset manager’s base case assumes bitcoin gains traction as a settlement tool and reserve asset over the next 25 years.

Crypto remains a key technology for maintaining America’s technological edge, according to a16z, which has raised another $15 billion to back American-aligned tech investments.

Grayscale registered Delaware trusts linked to potential BNB and HYPE ETPs, an early step that often precedes but does not guarantee ETF filings.

Bitcoin remained near $90,000 as trading volumes fell. Thin liquidity fueled choppy price action across major cryptocurrencies, while altcoins were mixed.

A new Digital Asset Act will regulate stablecoins, requiring 100% reserve backing and user redemption rights.

Zcash developer activity has fallen to its lowest level since 2021 as a governance dispute weighs on sentiment and ZEC extends a two-month decline.

A newly discovered vulnerability may enable malicious validators to omit the hash field when posting blocks, leading to validator crashes and slowing block production.

YZi accused CEA of mismanagement and poor communication, and is seeking changes to the board, disclosure of treasury holdings, and more.

Bitcoin retreated to five-day lows during as repeated failures to break through $94,500 reinforced a tight trading range.

Structural demand, historical timing, and January inflection points collide in 2026.

Bybit’s top performing fund saw returns of 20.3% APR driven by the exchange’s flagship high-yield USDT-based strategies.

ECC’s CEO, Josh Swihart, claims the team was forced to leave because of changes that made their work untenable.

Moody’s says stablecoins and tokenized deposits are evolving into institutional “digital cash,” with trillions in onchain settlement volume and billions in infrastructure investment.

Bitcoin fell during Asian trading hours after failing to break above $94,500, dragging the wider crypto market lower.

The Wall Street giant is widening its crypto push, following bitcoin and solana ETF filings with a potential ether trust.