Bitcoin doesn’t need gold and silver ‘to slow down,’ say analysts

The Bitcoin-to-gold ratio has strengthened because Bitcoin spent the past year in a “stagnant stage,” while gold enjoyed a “tremendous year,” according to Lyn Alden.

The Bitcoin-to-gold ratio has strengthened because Bitcoin spent the past year in a “stagnant stage,” while gold enjoyed a “tremendous year,” according to Lyn Alden.

The “fast-moving retail crowd” is one of the reasons Bitcoin is ending the year lower than it started, according to Bitwise CIO Matt Hougan.

Ethereum treasury firm Bitmine has begun staking Ether after depositing nearly $219 million worth of ETH into Ethereum’s proof-of-stake system.

JPMorgan has reportedly frozen accounts linked to Y Combinator–backed stablecoin startups BlindPay and Kontigo after flagging exposure to sanctioned jurisdictions.

The second half of 2026 will provide “more constructive conditions” for XRP to potentially surge, according to Nansen crypto analyst Jake Kennis.

Bitcoin reached new all-time highs in October, yet Jan3 founder Samson Mow has described the year as a “bear market” and anticipates a major bull run ahead.

A surge in stablecoins, tokenized RWAs and growing sovereign wealth fund interest could drive a major increase in Ethereum’s TVL in 2026, Sharplink’s co-CEO said.

Tether CEO Paolo Ardoino warned an AI sector correction could spill over into crypto markets in 2026, with some analysts projecting BTC to drop to as low as $65,000.

Changpeng Zhao, a co-founder of Binance, which owns the utility, said the losses will be reimbursed.

From McDonald’s to municipal taxes, Lugano is proving that Bitcoin adoption is not about predicting the future; it is about building the infrastructure to handle it today.

The malicious Trust Wallet extension has also been exporting users’ personal information, pointing to potential insider activity, according to cybersecurity company SlowMist.

Bitcoin simmered below resistance but teased a bullish breakout as the Asia trading session accompanied new all-time highs for gold and silver.

Market data showed shrinking participation across NFTs, with fewer buyers, sellers and transactions signaling fading speculative interest.

Bitcoin ETF performance remained negative on Christmas Eve as a short final US trading session produced another $175 million in net outflows.

The biggest single-day exit came from BlackRock’s IBIT, which saw $91.37 million leave the fund. Grayscale’s GBTC followed with a $24.62 million outflow.

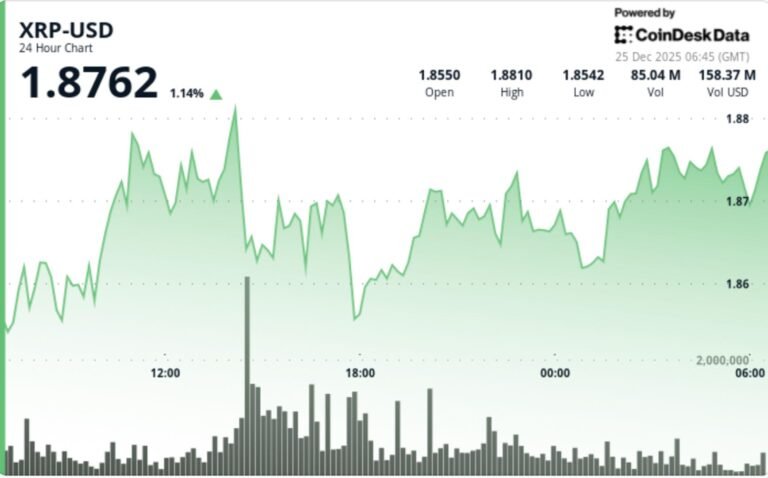

XRP remains in a $1.85–$1.91 range, with strong selling near $1.90 and consistent bids near $1.86, suggesting a potential decisive break ahead.

Crypto hackers took social engineering to a whole other level this year, and advances in artificial intelligence mean scams are about to get even harder to detect.

Bitcoin holds near $87,000 as on-chain activity and exchange inflows fall, signalling tight liquidity and looming volatility.

Ondo plans to launch tokenized US stocks and ETFs on Solana in 2026, using custody-backed assets, onchain transfers and embedded compliance.

The platform attributed the incident to a third-party login provider, which several users speculated was Magic Labs, a popular tool for email-based logins.

Several VC-backed crypto projects now trade at market capitalizations well below the valuations assigned during their last private funding rounds.

Philippine regulators are tightening control over crypto access, signaling that global exchanges must secure local licenses to operate.

VanEck data shows declining bitcoin mining activity has historically preceded strong returns in bitcoin.

Altcoin ETF flows are diverging, with Ether stabilizing, XRP drawing steady demand and smaller funds seeing uneven traction.

Harriet Hageman’s “Soon” teaser on X sharpens talk of a 2026 Senate bid to replace crypto ally Cynthia Lummis, raising the stakes for Wyoming’s pro‑crypto brand.

Bybit will phase out services for Japan-based users starting in 2026, following earlier steps to halt new registrations.

Bitcoin gained new warnings of a BTC price breakdown as gold and silver hit new all-time highs in the shadow of Japanese market instability.

The expiration involves over 50% of Deribit’s total open interest, with a bullish bias indicated by a put-call ratio of 0.38.

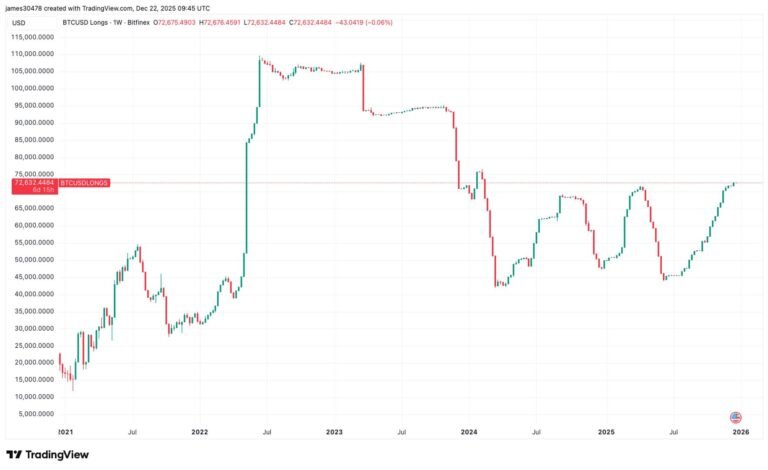

Margin long positions continue to climb, signaling strong conviction despite bitcoin’s weakness.

Indonesia’s OJK has identified 29 licensed digital asset and crypto trading platforms, just weeks after tightening digital asset rules.

Your look at what’s coming in the week starting Dec. 22.

Brazil’s crypto market showed signs of maturity in 2025, with higher transaction volumes, larger per-user investments and growing demand for low-risk products.

US lawmakers are proposing a $200 tax exemption for stablecoin payments and a multi-year deferral option for crypto staking and mining rewards.

Industry supporters said crypto “would not be where it is today” without US Senator Cynthia Lummis, who announced she would not seek reelection next year.

Social media sentiment indicates Bitcoin is in a range where a drop below $75,000 is possible, according to Santiment founder Maksim Balashevich.

Multiple factors, including ETF outflows, contracting demand, and price falling below key support levels, indicate the start of a BTC bear market.

A user lost nearly $50 million in USDt after copying a poisoned wallet address from transaction history, showing how subtle address spoofing can trick users.

A circulating report attributed to Fundstrat warns of a potential crypto drawdown in early 2026, setting downside targets for Bitcoin, Ether and Solana.

Blockstream CEO Adam Back said that Castle Island Ventures founding partner Nic Carter is “not helping” the ongoing quantum-Bitcoin narrative for Bitcoiners.

Bitcoin continued to sell near $90,000 as investors reacted to weak US jobs data and slowing economic growth by shifting into safer assets.

As market participants continue to speculate on when altcoin season will arrive, BitMEX co-founder Arthur Hayes argued there is “always an altcoin season happening.”

Terraform Labs sued Jump Trading and senior executives for $4 billion, alleging the firm manipulated Terra’s ecosystem and unlawfully profited from the crash, the WSJ reported.

Bybit is relaunching in the UK with a stripped‑back spot and P2P platform, reopening a market it exited after the Financial Conduct Authority’s (FCA) 2023 crackdown.

The crypto exchange is taking legal action against Connecticut, Michigan and Illinois, Chief Legal Officer Paul Grewal wrote on X.

Fidelity’s global macro director, Jurien Timmer, has called the end of the latest bitcoin bull run, while highlighting gold’s continued bull market strength.

New research models how crosschain price gaps and capital friction are eroding efficiency as tokenized markets scale across blockchains.

XRP looked increasingly bearish below $2, with multiple indicators suggesting that a downward move toward $1 was possible in the coming weeks.

The Wall Street titan’s recent embrace of a public blockchain is a harbinger of things to come.

Spot Bitcoin ETFs logged their strongest inflows in over a month amid renewed institutional demand tied to shifting macro expectations.

The approval follows a challenging year for CoinDCX which included a significant security breach, though customer funds remained safe.