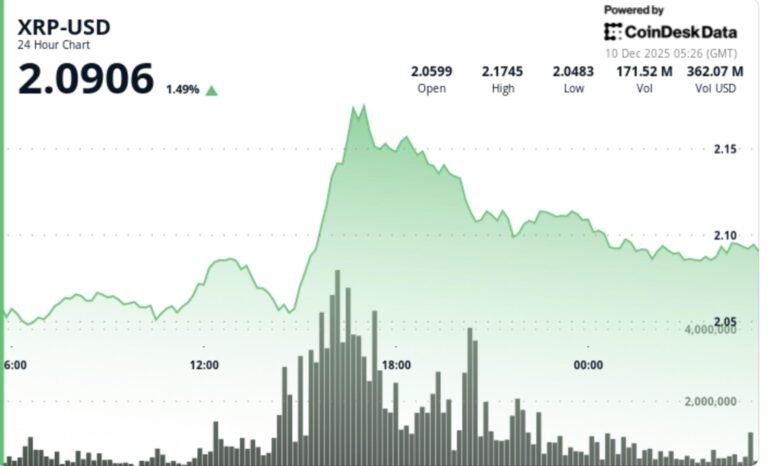

Is XRP crashing? The sustained break below $2 signals trouble

XRP’s price chart paints a bearish picture, but a softer-than-expected U.S. inflation could spark a rebound.

XRP’s price chart paints a bearish picture, but a softer-than-expected U.S. inflation could spark a rebound.

The Himalayan kingdom plans to deploy part of its sovereign bitcoin holdings to fund long-term development through Gelephu Mindfulness City.

Bitcoin buying power from institutions flipped the daily mined BTC supply for the first time since the start of November, new data showed.

KuCoin is using a freshly minted MiCA license to wire crypto payments and perks into Tomorrowland’s flagship festivals.

The proposal seeks a binding social consensus that the funds will never be accessed through future protocol upgrades.

HashKey debuted on Hong Kong’s HKEX following a $206 million oversubscribed IPO, with the stock seeing notable volatility on its first day of trading.

The amount of Bitcoin in long-term holder wallets hit cyclical lows, but is this enough to help the bulls avoid a decline toward $68,000?

The health-care and bitcoin treasury firm has six months to lift its share price above $1 for 10 consecutive days.

Gemini’s prediction markets go live nationwide in the US following federal approval, joining a race among crypto companies to build “everything apps.”

Past record spikes in Bitcoin accumulation preceded major rallies, including a 900% surge in 2012 and a 350% rise in 2011.

Crypto’s bear grip squeezes tighter as 75 of top 100 coins trade below 50- and 200-day SMAs.

Legislation will be introduced into Parliament on Monday extending existing financial regulation to crypto companies.

The latest death cross in November has so far marked a bottom of around $80,000, aligning with prior examples this cycle.

Your look at what’s coming in the week starting Dec. 15.

Nasdaq and MOVE index patterns warrant caution for BTC bulls.

The deal achieved T+0 settlement on a permissioned distributed ledger rather than a public blockchain, reflecting a growing regional shift toward regulated digital bond infrastructure.

Twenty One Capital’s NYSE listing showed how tightly markets now price Bitcoin-heavy firms, with investors refusing to pay much beyond the underlying BTC value.

Michael Saylor explains why governments should consider Bitcoin-backed digital banks. It is time to examine the potential benefits and risks of Bitcoin banks.

Standard Chartered and Coinbase are expanding their partnership to develop trading, custody and financing services aimed at institutional crypto clients.

Spot XRP exchange-traded funds continued a streak of positive flows, with over $20.1 million recorded on Friday, marking 19 consecutive days of net inflows.

The crypto ecosystem in Venezuela is a product of ongoing economic collapse and international sanctions pressure, according to the TRM Labs team.

Brazil’s largest private bank says Bitcoin can improve portfolio diversification and hedge currency risk despite a volatile year for the asset.

The DeFi Education Fund has led a rebuttal to Citadel Securities’ call for the SEC to bring DeFi platforms under securities laws if dealing in tokenized stocks.

Tether says it will buy the controlling stake Exor has in Juventus, along with all remaining shares, an offer Exor has reportedly rebuffed.

Regulations must evolve for tokenized real-world assets to be better integrated with DeFi, so their immediate benefit won’t be significant, says NYDIG’s Greg Cipolaro.

The investing giant had asked the U.S. Securities and Exchange Commission to treat DeFi players like regulated entities, and the DeFi crowd pushed back.

Bitcoin price targets included $76,000 and $50,000, thanks to growing bearish BTC price divergences and a lack of upward price momentum.

BTC continues to bore traders with its directionless price action. But some indicators are pointing to renewed bullishness.

Traders appeared more focused on preserving trend structure than chasing upside, with flows concentrated in large-cap assets.

The CFTC gave “no-action” letters to a group of prediction markets, including Polymarket US, exempting them from swap data reporting and record-keeping regulations.

The Blockchain Game Alliance reports industry confidence rose to 66% as developers pivoted from speculation to sustainable models following a funding collapse since 2021.

State Street Investment Management and Galaxy Asset Management are launching a tokenized private liquidity fund on Solana, with Ondo expected to invest $200 million.

Gemini said its affiliate Gemini Titan won CFTC approval to operate a Designated Contract Market, allowing the firm to offer regulated prediction markets in the U.S.

The pullback followed Tuesday’s brief spike above $94,500, a move that triggered a minor short squeeze but failed to break the resistance that has capped bitcoin for most of the past three weeks.

Binance, Hyperliquid, and Bybit were the most affected exchanges, comprising 72% of all forced unwinds.

There are five other Satoshi statues made by Valentina Picozzi located around the world, in Switzerland, El Salvador, Japan, Vietnam and Miami, in the US state of Florida.

The IMF warns that USD-pegged stablecoins could undermine local currencies in emerging markets by facilitating currency substitution and capital outflows.

Solv generates Bitcoin yield through lending markets, liquidity provisioning to automated market maker pools, and participation in structured staking programs.

A US judge has handed Kalshi a small win after putting a temporary stop to the Connecticut Department of Consumer Protection’s enforcement action against the company.

Despite briefly reaching $2.17, XRP failed to maintain momentum, suggesting large holders may be unwinding positions rather than accumulating.

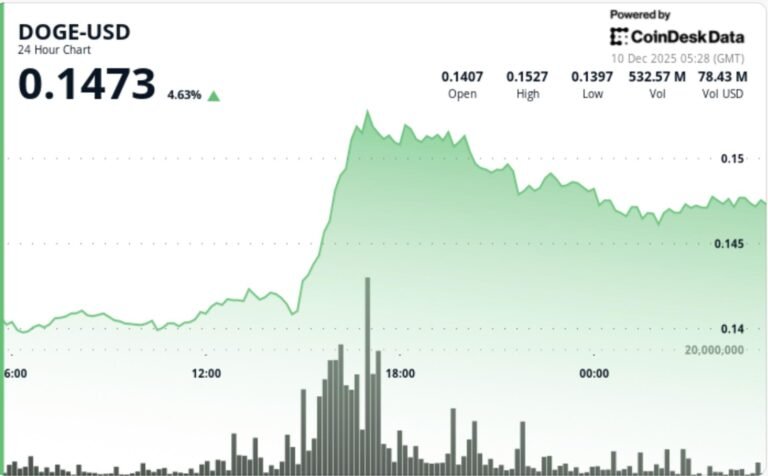

Despite the breakout, DOGE faces significant structural resistance from major EMAs.

NFT sales fell to $320 million in November — their lowest this year — with early December off to a weak start as top collections slide across the board.

Bitcoin retail investors have been sending fewer BTC to Binance per day than at any time in history, despite the new highs of the 2025 bull market.

Wide crypto-tracking funds will become more popular as investors will seek exposure as the market becomes more complex, says Bitwise’s Matt Hougan.

ZEC zoomed 12% amid the fee discussion, beating gains across all major tokens.

The license allows Circle to expand USDC payment and settlement tools across the United Arab Emirates.

Coinbase has reopened India app registrations, with local fiat on-ramps planned for 2026 following a rocky exit more than two years ago.

The ruling transfers cash, gold bars, watches, and jewelry seized from a CIBC safety deposit box and bank account into government hands after Patryn did not defend the case.

The protocol still consists of casts, follows, reactions, identities and wallets, and third-party clients are free to emphasize whichever components they want.

Binance’s international operations and liquidity will now be supervised end-to-end by the Financial Services Regulatory Authority in the financial free zone in Abu Dhabi.